According to official sources, FCI’s grain stocks (central pool stocks built up under a virtually open-ended procurement policy) is already close to its capacity of 76 million tonne (MT).

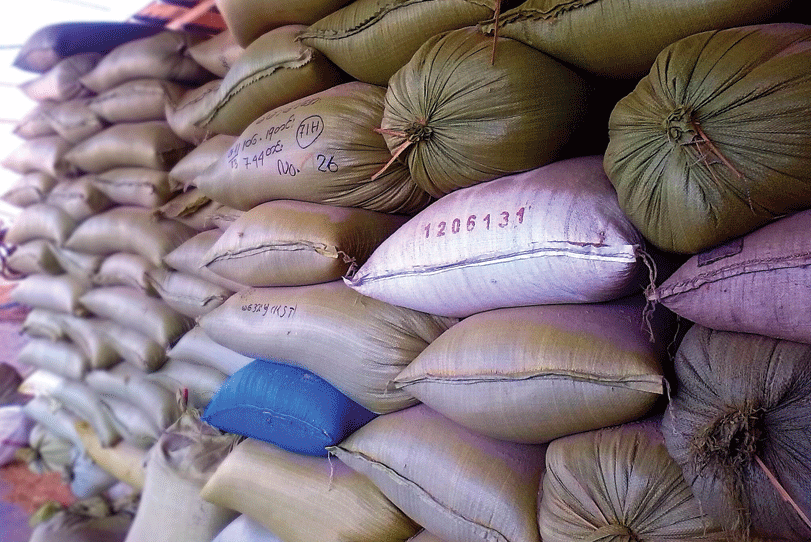

The Food Corporation of India (FCI) is badly hamstrung: even as its `1.95-lakh-crore bills to the government remain unhonoured and a debt crisis is looming, it hasn’t yet got the nod for liquidating its patently surplus grain stocks through massive open market operations (OMOs). According to official sources, FCI’s grain stocks (central pool stocks built up under a virtually open-ended procurement policy) is already close to its capacity of 76 million tonne (MT). Given the expected (low) pace of off take under PDS and other government schemes, the requirement to shift the huge paddy stocks now lying with millers and the mandated rabi wheat purchases effective April, it may face a serious storage problem in a few weeks. Even if the OMOs result in losses, it would still be a far better way for FCI to manage its operations as the realisations will ease its liquidity issues and enable it to retire part debt. Over three years in a row, the fiscally stressed Centre has made FCI take National Small Savings Fund (NSSF) loans under sovereign guarantee to ensure the corporation’s operations aren’t disrupted. However, the Centre’s dues to the FCI have now touched an all-time high and FCI is being made to borrow more from NSSF.

Sources said FCI had 56 MT of rice and wheat in its own and hired facilities and another 26 MT of paddy (rice equivalent of 17 MT) procured for the central pool lying with millers as of December 1. While the stocks with millers will need to be shifted to FCI warehouses by April, another 16-17 MT of kharif rice is likely to be bought by the corporation over the next four months as part of kharif procurement. Add to this the rabi wheat purchases to start from April and the storage problem will get worse. According to official data, FCI has purchased 25.2 MT of rice between October and December 2019 in the current kharif season, which is more than half of the total quantity it bought in the whole of 2018-19 (October-September). From Uttar Pradesh, India’s second-largest rice producer, the agency has procured 2.6 MT for this kharif season, as on December 30 against 1.4 MT in the year-ago period. If this trend continues, FCI will end up procuring about 46 MT of rice this year from across the country, against 34.4 MT in 2018-19.

It has to make room for wheat crop of around 35 MT to be procured in April-May out of its total storage capacity. Given that PDS off take from the central pool is expected to be less than 25 MT till April, FCI would have to grapple with a storage problem if OMOs aren’t quickly stepped up.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

![12 [2]](https://www.thermalcontrolmagazine.com/wp-content/uploads/2021/08/12-2-300x180.jpg)

![12 [1]](https://www.thermalcontrolmagazine.com/wp-content/uploads/2021/08/12-1-300x180.jpg)