The global industrial refrigeration market is set to soar from $24.7 billion in 2022 to $41.7 billion by 2032, driven by expanding cold-chain industries and technological advancements.

The global industrial refrigeration market size was valued at $24.7 billion in 2022, and is projected to reach $41.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Industrial refrigeration systems are widely used in various industries, including food and beverage processing, cold storage facilities, chemical and petrochemical, pharmaceuticals, and other sectors that produce products which require cold and controlled temperatures during storage and transportation. By using refrigeration systems, industries can ensure the quality, freshness, and longevity of perishable goods, and facilitate the seamless functioning of various industrial operations.

Market Dynamics

The industrial refrigeration market is primarily driven by various factors such as growth in food and beverages and pharmaceutical industries, rise in cold-chain industries, and increase in industrialization in developing economies. In these industries, industrial refrigeration is used for maintaining a conducive environment for the storage and transportation of perishable goods, as well as volatile chemicals. Moreover, various industries use refrigeration systems such as chillers, compressors, and other components to keep the machines cool in industries as well as in data centers.

Furthermore, world trade is rising at a rapid pace, which is expected to increase the demand for cold-chain industries. According to the World Trade Organization, the overall monetary value of international trade involving physical goods reached value of $25.3 trillion in the year 2022. Projections indicate a gradual expansion of 1.7% in 2023, which is expected to grow substantially by 3.2% in 2024. A significant portion of this extensive trade include perishable products that require specific temperature conditions to maintain their quality and prevent spoilage. These goods are typically from sectors such as pharmaceuticals, both frozen and non-frozen food and beverages, chemicals, and various other industries. In addition to this, the demand for frozen and non-frozen foods & beverages such as ice-creams, desserts, meat, poultry, dairy, and others is also rising across the world. According to the American Frozen Food Institute (AFFI), the retail sales of frozen food increased significantly by 23% in 2021, as compared to 2019. Furthermore, similar development can be seen in Europe also. For instance, based on data provided by the Freshfel Europe’s Consumption Monitor, the European Union witnessed a notable surge in fruit and vegetable consumption in 2021. The per capita daily consumption of these fruit and vegetable products reached 364.58 grams, marking a substantial growth of 2.2% compared to the previous year i.e., 2020. Furthermore, this figure surpasses the average consumption of the European Union over the last five years by 1.27%. This upward trend indicates an increasing preference for, and awareness of the health benefits associated with the consumption of fruits and vegetables within the European Union population. Thus, owing to growth in trade and consumption of perishable products, various companies involved in providing cold-chain logistics are expanding their capabilities. For instance, in December 2022, a 5,000 metric ton capacity cold-storage facility began its operation in the state of Assam in India. This cold storage facility is said to be the largest in the Northeastern region of the country. These facilities significantly require various refrigeration systems; therefore, many companies in the refrigeration market have launched their refrigeration products for cold-chain industry.

However, according to the U.S. Environment Protection Agency, a typical food retail store leaks an estimated 25% of refrigerant annually, leading to negative impact on the environment. This emphasizes the importance of regulating the use of refrigerants to protect the planet. Thus, governments across the world have implemented strict regulations on a wide range of refrigerants that have adverse effects on the environment which is expected to restrain the market growth. For instance, the U.S. government has also planned to ban the use of high GWP refrigerants, including R134a, R410A and R407C, from use in new chillers in the U.S. from January 1, 2024.

Moreover, among various industrial refrigeration market opportunities, technological and other developments in the refrigeration systems are expected to positively affect the key market players in the coming years. For example, technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), cloud connectivity, and others are also being incorporated into industrial refrigeration. For example, the Danfoss iMCHE allows different circuits to use a single coil’s heat transfer area, eventually boosting the efficiency of the system by over 20%. This also helps in maximizing heat-transfer efficiency, and reducing refrigerant charge in a compact, lightweight design. Moreover, it also offers the CO2 Adaptive Liquid Management (CALM) Solution for its Refrigeration category.

The industrial refrigeration market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and the economic slow-down due to inflation across the world. Earlier, the worldwide lockdowns due to COVID-19 resulted in reduced industrial activities, eventually leading to reduced demand for industrial refrigeration from various sectors such as food and beverages sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rising global inflation which is soon expected to cause recession in major economies is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of food and oil & gas, including raw materials used for manufacturing industrial refrigeration systems. Furthermore, the countries in Europe, Latin America, North America, the Middle East, and Sub-Saharan Africa are experiencing severe negative impacts on industrial production, including the production of industrial refrigeration systems. However, India and China are performing relatively well, and the industrial refrigeration market outlook is positive in these countries. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. Moreover, the cost of food products has risen substantially, discouraging their trade, which is also expected to have slight negative effects on the industrial refrigeration market growth. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Segmental Overview

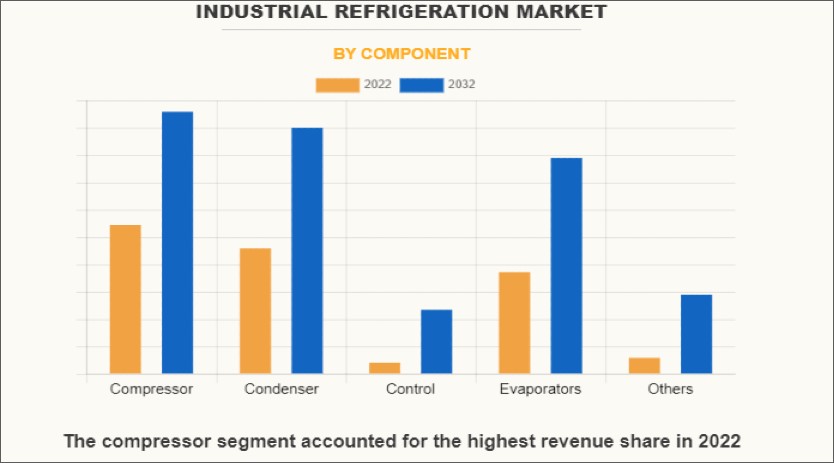

The industrial refrigeration market is segmented on the basis of component, refrigerant type, application, type, sales type, and region. Depending upon the component, the market is categorized into compressor, condenser, control, evaporator, and others. On the basis of refrigerant type, it is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), hydrochlorofluorocarbons (HCFC), and others. As per application, the market is classified into fresh fruits and vegetables, meat, poultry and fish, dairy and ice cream, beverages, chemicals, pharmaceuticals, petrochemicals, and others. Furthermore, on the basis of type, it is divided into stationary refrigeration and transport refrigeration. According to sales type, the market is classified on the basis of new sales and aftermarket.

By component: The industrial refrigeration market is divided into compressor, condenser, control, and others. In 2022, the compressor segment dominated the industrial refrigeration market share, in terms of revenue, and the others segment is expected to grow with a higher CAGR during the forecast period. A compressor is one of the main components of a refrigeration system which consumes a large amount of energy. Thus, major companies are offering compressors that provide energy-efficient, reliable, and sustainable refrigeration. Moreover, refrigeration systems are very basic and require advanced control systems so that an automated, energy-efficient, and reliable operation of the refrigeration system can be achieved; thereby, driving the demand for various control systems.

By refrigerant type: The industrial refrigeration market is divided into ammonia, carbon dioxide, hydrofluorocarbons (HFC), hydrochlorofluorocarbons (HCFC), and others. In 2022, the ammonia segment dominated the industrial refrigeration market, in terms of revenue, and the carbon dioxide segment is expected to witness growth at a higher CAGR during the forecast period. Ammonia is a natural refrigerant and does not cause any harm to the environment; therefore, it is witnessing an increased demand. In adidtion, Hydrofluorocarbon (HFC) refrigerants are being phased out from commercial applications due to increasing concerns of environmental issues such as the depletion of the ozone layer and global warming. Furthermore, carbon dioxide is a cheap refrigerant, widely available and easily obtainable from the combustion of hydrocarbons, which is a reason for its high CAGR throughout the forecast period.

By application: The industrial refrigeration market is categorized into fresh fruits and vegetables, meat, poultry and fish, dairy and ice cream, beverages, chemicals, pharmaceuticals, petrochemicals, and others. The meat, poultry and fish segment accounted for a higher market share in 2022. This is attributed to increased consumption of these products driven by the rising disposable income of people. However, the pharmaceuticals segment is anticipated to register a higher growth rate throughout the forecast period, owing to the increased demand for chemicals from almost all types of manufacturing industries, including textiles, petrochemicals, electronics, plastic, and other industries.

By type: The industrial refrigeration market is divided stationary refrigeration and transport refrigeration. In 2022, the stationary refrigeration segment dominated the industrial refrigeration market, in terms of revenue, and the transport refrigeration segment is expected to witness growth at a higher CAGR during the forecast period. Stationary refrigeration systems are immovable and are permanently fixed in their places. Relatively, they are big and have larger capacities than the transport ones. Rapid expansion of refrigerated warehouses for storing and processing food and beverages has fueled the demand for industrial stationary refrigeration. On the other hand, rise in trade of perishable goods is driving the growth of transport refrigeration.

By sales type: The industrial refrigeration market is categorized into new sales and aftermarket. The new sales segment accounted for a higher market share in 2022, owing to an increase in the number of new cold warehouses, and food and beverages and pharmaceutical manufacturing facilities. However, the aftermarket segment is anticipated to register a higher growth rate throughout the forecast period. This is attributed to the high requirement of the repair and maintenance of refrigeration systems.

By region: Asia-Pacific was the largest contributor to the global market revenue in 2022, and is expected to maintain its dominance during the forecast period. On the other hand, LAMEA is expected to emerge as a region with maximum growth potential in the coming years. Asia-Pacific is the fastest growing industrial refrigeration market. The increase in food demand, growth in the cold storage market, and rise in the number of refrigerated warehouses in the region have fueled the growth of the industrial refrigeration market. Major demand is generated especially from countries such as China and Japan. Moreover, the surge in demand for frozen and processed food items in LAMEA has boosted the growth of the industrial refrigeration market. Further, the increase in the export of perishable products to the U.S. has supplemented the growth of the industrial refrigeration market in LAMEA.

Source: https://www.alliedmarketresearch.com/industrial-refrigeration-market

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.