The commercial food refrigeration equipment market is anticipated to experience growth due to the rising demand for frozen foods and the increasing number of food products that require refrigeration.

The use of food refrigeration equipment has become essential in reducing food waste during production and distribution. According to TMR’s commercial food refrigeration equipment market report, the global market is expected to grow at a CAGR of approximately 6 percent during the forecast period due to various factors elaborated on in the report.

Greenhouse gas reduction drive boosts natural refrigerant acceptance.

Rising concerns about global warming caused by greenhouse gas emissions have led to a worldwide phasedown of hydrofluorocarbons (HFCs). As a result, natural refrigerants are being encouraged as an alternative to HFCs. Carrier launched Puron Advance in 2018, a refrigerant for light commercial products and serves as the primary lower GWP solution, replacing R-410A to minimize environmental impact. It is a next-generation refrigerant that surpasses the expected future regulations and will be offered in all Carrier products from the beginning of 2023.

The market report predicts that the refrigerators and freezers segment will outpace other product types by the end of 2027 in the commercial food refrigeration equipment market. The primary reason for the growth in demand for commercial food refrigeration equipment across the globe is the increasing networks of food service equipment in numerous geographies. Commercial restaurants’ increasing awareness about food preservation is also expected to drive the commercial food refrigeration equipment market’s growth from 2019 to 2027. Prominent countries in the Asia Pacific have witnessed tremendous population growth over the last decade, contributing to the demand for commercial food refrigeration equipment. Technological developments in commercial refrigeration equipment are expected to boost the demand for the product during the forecast period. Additionally, increasing food safety and quality regulations, along with the growing consumption of processed food and beverages, are expected to drive further commercial food refrigeration equipment market growth.

Commercial refrigeration equipment consumes high energy to preserve food, increasing operation costs for small food processors. Due to budgetary constraints, commercial refrigeration equipment is not viable for small establishments such as grocery stores and local markets. These factors are expected to hamper the growth of the commercial food refrigeration equipment market over the forecast period.

Prominent regions

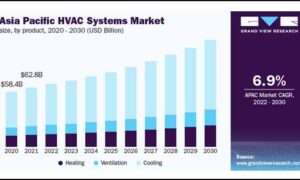

The Asia Pacific commercial food refrigeration equipment market is expected to grow significantly, driven by the region’s growing food service sector and expanding food distribution network. In developed regions such as North America and Europe, the rising demand for frozen foods drives commercial food refrigeration equipment sales, particularly blast freezers, walk-in refrigerators and freezers, and hinged door merchandisers due to their high durability and reliability. Meanwhile, the Middle East and South American markets are expected to show moderate growth in the commercial food refrigeration equipment market shortly.

Key manufacturers and market players

The commercial food refrigeration equipment market aims to enhance its competitive edge by demonstrating synergies through close collaboration and cooperation in sales, marketing, and production. To meet the growing demand, commercial food refrigeration equipment manufacturers are also expanding through organic methods such as increasing production capacity.

The key players in the global commercial food refrigeration equipment market are Blue Star Limited, Carrier Corporation, Daikin Industries, Ltd., Danfoss A/S, Dover Corporation, Hussmann International, Inc., Illinois Tool Works, Inc., Lennox International, Inc., Metalfrio Solutions SA, and Standex International Corporation.

Commercial food refrigeration equipment encompasses various equipment, such as refrigerators & freezers, display cases, beverage dispensers, ice cream machines, ice machines, and refrigerated vending machines. The refrigerators segment is further classified into walk-in refrigerators & freezers and reach-in refrigerators & freezers, which are divided into glass door merchandisers and beverage refrigerators. The freezers segment includes blast freezers and others.

Source: Transparency market Research

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.